Go BESS or Go Broke

Cyprus takes its first shot at BESS with a subsidy scheme to tackle its energy flexibility crisis. But will it work?

What better way to commemorate Valentine’s day than with the opening of Cyprus’ first energy storage subsidy scheme to applications?

The scheme, funded with €35 million from the EU joint transition fund, is aiming to add 350MWh of batteries to existing solar, wind & biomass.

The idea is that the systems will help reduce the island’s spiralling curtailment issues - with more than a quarter of all power generated in 2024 forcibly curtailed by a network operator that is buckling under the weight of their own multi-decade procrastination.

According to data from Cyprus Grid, 3.5% of renewable energy was curtailed in 2022. This rose to 13.4% in 2023 and over 28% in 2024 with some months averaging over 50% and some days in Spring seeing over 80% of generated power thrown away.

The problem has long plagued utility-scale projects, but it’s now so severe that even residential systems are being shut off - sparking predictable outrage.

BESS to the rescue?

What’s on offer

The first surprise is that the scheme is only available to renewables currently selling their power through a Feed-in-Tariff (FiT).

This immediately excludes the 294MW of solar capacity that operates in what is known as the ‘transitional market’. This was the first step towards energy market liberalisation where generators for the last five years have been allowed to contract power purchase agreements (PPAs) with a selection of newly licensed private suppliers.

These sites and their investors have suffered just as badly from curtailment as FiT sites, which are contracted directly with EAC, but they are excluded from subsidy eligibility nonetheless. Perhaps for the sin of believing in free markets.

For the 163MW of PV capacity contracted directly with EAC (system operator), the potential subsidy is as follows:

The proposal would see EAC control and operate any systems built. The grant mandates any installation over 120kW have at least 3-hours of duration.

It is critical to point out here that, subsidy aside, the only possible incentive for installing these systems is to limit curtailment. There is no intraday wholesale market, no balancing market and certainly no ancillary services that these systems would be able to earn revenue from.

An important clarification here is that, unlike in some other markets, curtailment is enforced operationally by the system operator (SO) rather than being managed through an economic redispatch or market mechanism. The SO either issues commands through SCADA connections for plants above 120kW or employs frequency-based ripple control to communicate with smaller inverters. They curtail generators, who are not compensated at all for this lost power, entirely at their own discretion.

In other words, investors must contemplate incurring the CAPEX to install these systems for the sole purpose of continuing to realise revenues that they would have expected when they built their PV parks. It’s a tough pill to swallow.

So, is curtailment bad enough?

The maximum subsidy attainable is €300,000/MWp, suggesting 3-hour systems are most likely to be built.

For our example, we’ll take a 2MW, 6MWh storage unit and assume in this case that it is coupled to a solar farm with a 2MW-ac export capacity - a typical co-location setup aimed at maximising grid connection capacity.

We can calculate the Levelised Cost of Storage for this system with the subsidy and try to understand, based on curtailment levels, whether the system will cycle enough, with enough of a price spread to make economic sense.

More than 70% of the budget is allocated for projects with the lowest FiT, so let’s start there.

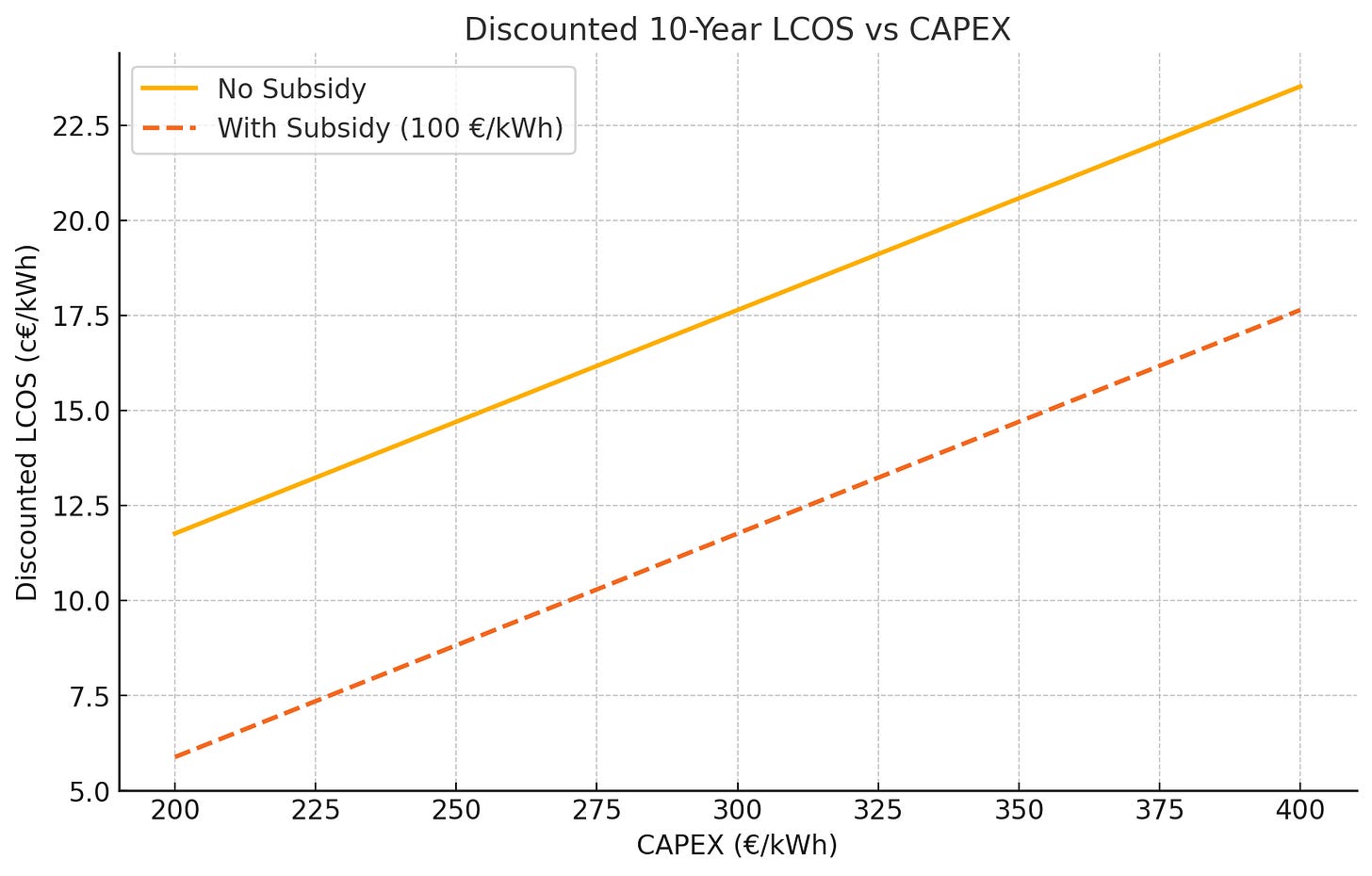

Assumptions used include 2.5% annual degradation, 1 cycle per day, 2% of unsubsidised CAPEX incurred annually as OPEX, 85% depth of discharge and 96% round-trip efficiency. Payback required over 10-years at an 8% discount rate.

There is little local precedent for battery system installations from which to gauge CAPEX, but for a 3h system of about 6MWh, we’d expect something in vicinity of €300/kWh installed.

This gives a LCOS of €0.125/kWh, vs the unsubsidised version of €0.187/kWh. The subsidy would appear to have done it’s job here, bringing the LCOS below the effective capture rate of €0.166/kWh that results from a unit of generated solar power either being exported at the agreed FiT price, or curtailed and lost forever.

But this assumes that the asset performs a cycle per day, which will require at least 5.1MWh (accounting for depth of discharge as we have done in our LCOS calculation) of power to be curtailed every day from the 2MWp-AC solar farm.

Fortunately we have some PV curtailment data we can look at, from 2024. Below you can see the daily curtailed power from a 2MW-ac solar farm.

Doesn’t look great, but then cycling isn’t binary. Partial cycles are possible and will happen. In fact, we can calculate the breakeven cycle rate which the asset would need to achieve with a €0.166/kWh spread.

All other assumptions constant, we need a daily average of 0.80 cycles, or 4.08MWh exported, to breakeven. So, is the average daily curtailment high enough to meet this?

Trimming off curtailment that is over 5.1MWh per day (we can’t charge this into the battery) we get 2.29MWh as a daily average, meaningfully below the breakeven cycle rate.

Based on the above, the investment doesn’t work. Even if we extend the lifespan to 15-years, the breakeven cycle rate at this FiT rate is 0.68 cycles per day, still above what we get from solar curtailments with this setup.

This can be partially solved by downsizing the BESS system. If the size is halved to 3MWh, the breakeven threshold falls to 2.04MWh per day, which here is achieved.

Downsizing like this would likely put upwards pressure on the per kWh CAPEX and perhaps make the scheme’s 350MWh goal more challenging, but with FiTs fixed and curtailment/operations entirely in the hands of the system operator, it is likely the only tool in the investor shed for making these systems pencil.

An important assumption we’re making here is that curtailment stays level. There will be both continued upwards and new downward pressures on this as more PV is deployed and the first BESS systems start to come online, so it is unclear exactly how this trend will develop.

Certainly, any reduction in PV curtailment would make the BESS business case very challenging, even with the subsidy. If EAC’s figures are even remotely similar to what we’re modelling here, the logical deduction is that they know (and expect the market to anticipate) that PV curtailments will get considerably worse, jeopardising the solvency of operating projects.

What about Net-Billing?

Net-billing applies to customers who have installed PV alongside load. It works effectively like a FiT, with the caveat that it is not possible to be paid for your energy (only to net it off your consumption and reduce your bill).

There are 87MWs of PV contracted into net-billing in Cyprus.

These commercial customers will generally be paying around €0.28/kWh for power, while EAC will buy excess from them at €0.11/kWh.

This means that the value of generated PV power depends on it’s correlation with the load - if it’s generated and consumed immediately, offsetting grid consumption, it’s worth €0.28/kWh. If it’s put into the grid because there isn’t enough consumption to use it, it’s worth €0.11/kWh.

There is €75,000/kWh available as a CAPEX subsidy for these installations.

Going here with a CAPEX assumption of €325/kWh to account for the smaller individual installation size, we get a breakeven spread with the subsidy applied of €0.156/kWh over 10-years.

10-years is perhaps optimistic for C&I installations, as many businesses will require a faster payback than we can consider for utility-scale projects. A 5-year payback pushes this required spread to €0.24/kWh.

Nevertheless, it would appear with a business able to think long-term, we're in the green, with the spread of €0.17/kWh (€0.28/kWh - €0.11/kWh) beating the breakeven LCOS threshold at €0.156/kWh.

A sizeable caveat lies in the assumption here that there’s a 0% time correlation between PV production and load. This might be the case for a few nightclubs with a large solar-covered parking, but it’s not going to be common.

With our figure, though, we need at least 0.95 cycles per day for the system to breakeven. This threshold may be unachievable for businesses outside of literal nightclubs, as even with a dramatically oversized solar system and undersized battery there will likely still be days where limited sunlight means it’s not generating solar excess that would be available for export or BESS charging.

So will this work?

Based on the assumptions here, it seems unlikely. Investors may take more optimistic views on CAPEX and have a lower discount rate, but even then it doesn’t seem like BESS has the potential to be anything other than a panicked hedge against the risk that projects are completely sunk by curtailment.

EAC are under a lot of pressure to ‘fix’ high energy prices. Their recently proposed single buyer model, which I covered here, seems to indicate an intention to continue business-as-usual on the operational side while somehow compelling private investors to foot the bill.

I think, while masquerading as a helpful subsidy, this is much of the same approach. BESS remains unviable under current market design. Instead of reforming it (as they have been promising for the last 15-years), their plan is to hold PV investors over the barrel of potentially crippling curtailment, forcing them to put their hands in their pockets again just to stay alive.

Go BESS or go broke.

Having read this very long write up regarding solar power, I am still in the dark as to weather I should invest in this mode of power.

As I am an average intelligent man, i ask the question why, o why is this information not printed in simple terms so we can understand what the boffins are talking about.

Great article Karim! You knowledge of details on the topic is impressive!